work opportunity tax credit questionnaire social security number

APPLICANT INFORMATION See instructions on reverse. Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now.

Work Opportunity Tax Credit What Is Wotc Adp

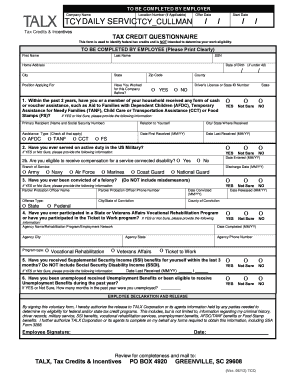

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

. Questions and answers about the Work Opportunity Tax Credit program. Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure WORK OPPORTUNITY TAX CREDIT WOTC QUESTIONNAIRE First Name Last Name Address City State Zip Date of Birth Social Security Number a. Asking for the social security number on an application is legal in most states but it is an extremely bad practice.

The Protecting Americans from Tax Hikes Act of 2015 Pub. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. SignNow allows users to edit sign fill and share their all type of documents online.

Complete only this side. After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. However when the worker already has a TIN taxpayer identification number or Social Security number the employer doesnt need to verify citizenship.

I dont feel safe to provide any of those information when Im just an applicant from US. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups.

Level 1 4 yr. Ad File With TurboTax Live And Know Where Your Taxes Stand From Start To Finish. Updated on September 14 2021.

The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. This tax credit program has been extended until December 31 2025. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are based on age.

WOTC is authorized until December 31 2025 Section 113 of Division EE of PL. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work opportunity tax credit program.

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Work Opportunity Tax Credit 1. In Box 8 indicate whether the applicant previously worked for the employer and if Yes enter the last date or approximate last.

Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. Employers can verify citizenship through a tax credit survey. The employee groups are those that have had significant barriers to employment.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Its asking for social security numbers and all. Felons at risk youth seniors etc.

Dont Know How To Start Filing Your Taxes. Your name Social security number a Street address where you live City or town state and ZIP code County Telephone number. Fill in the lines below and check any boxes that apply.

Is it legal for a companies to require that you fill out a tax credit screening in order to complete a job application. Some companies get tax credits for hiring people that others wouldnt. The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire.

Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. Enter the applicants name and social security number as they appear on the applicants social security card. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

116-260 -- Consolidated Appropriations Act 2021. The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. Completing Your WOTC Questionnaire.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements.

Get answers to your biggest company questions on Indeed. The Work Opportunity Credit a See separate instructions. 114-113 the PATH Act reauthorizes the WOTC program and Empowerment Zones without changes through December.

The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF. This program is designed by the federal government to help companies hire more people into the workforce and to retain employees through federal incentives. There are two sets of frequently asked questions for WOTC customers.

It says on the questionnaire the completion is optional but on the Panera site it says I. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Below you will find the steps to complete the WOTC both ways.

SSI does NOT include Social Security Disability Retirement or Death Benefits. Connect With An Expert For Unlimited Advice. Make sure this is a legitimate company before just giving out your SSN though.

Some states prohibit private employers from collecting this information for fear of identity theft It is not recommended that you provide this information on. Its called WOTC work opportunity tax credits.

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Questionnaire